Understanding the Growth of the UK Pet Insurance Market

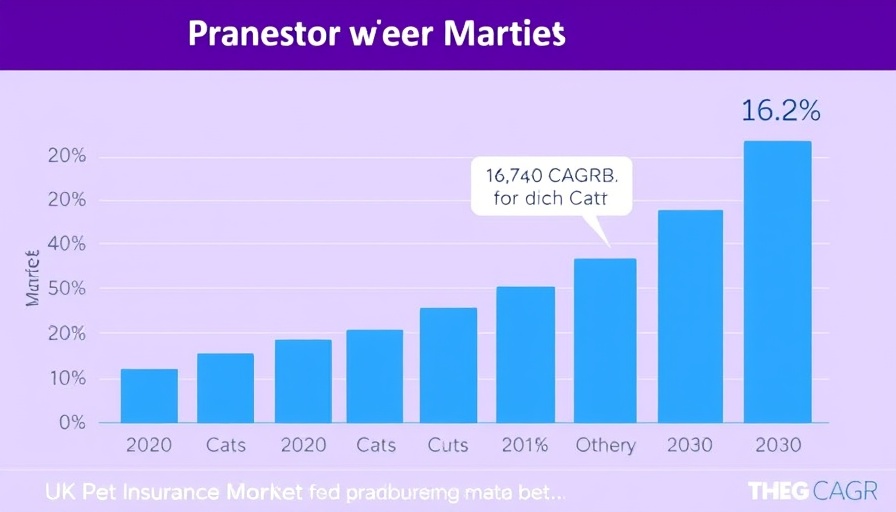

The UK pet insurance market is thriving, with estimates projecting its value to reach USD 2.04 billion in 2024. This remarkable growth trajectory indicates a compound annual growth rate (CAGR) of 16.2% expected from 2025 to 2030. Various factors contribute to this surge, primarily centered on the growing importance of pet insurance, improvements in veterinary care, increased regulatory scrutiny, and heightened awareness among pet owners.

The Importance of Pet Insurance in the UK

Pet owners in the UK are increasingly recognizing the significant role of pet insurance in safeguarding their pets against unforeseen emergencies. A recent report from Agria Pet Insurance underscored this trend, revealing that about 14% of UK adults face pet emergencies without knowing how to respond, which raises serious concerns. Notably, around 20% of pet owners have never considered pet first aid. This knowledge gap underscores the pressing need for comprehensive pet care solutions, reflecting a broader trend towards responsible pet ownership.

Challenges Facing the Pet Insurance Business

While the market is on the rise, it faces challenges, including fraud and increasing premiums that can deter potential customers. Insurers must work harder than ever to combat fraudulent claims, which can lead to higher premiums and undermine trust in the industry. However, the proactive steps taken by insurers, such as more robust vetting processes, are essential to ensure the stability and integrity of the pet insurance market.

Growth Drivers: Improved Marketing Strategies

Innovative marketing strategies are propelling the awareness and uptake of pet insurance. A notable example is the partnership between Napo Pet Insurance and Metro to launch campaign initiatives aimed at commuters. This strategy, which features 'Mr. McPickleface', cleverly taps into everyday life and showcases the importance of holistic pet care alongside insurance. The use of digital and out-of-home (OOH) advertising coupled with social media campaigns aims to bridge the knowledge gap about pet emergencies among potential pet insurance customers.

Future Trends in Pet Insurance

As the landscape evolves, pet insurance is likely to incorporate more personalized and tailored options catering to individual pet needs. This trend aligns with the general shift in consumer expectations across various sectors towards custom solutions. Furthermore, advancements in technology will facilitate more efficient claims processes and provide pet owners with enhanced access to veterinary care and preventative health resources.

Decisions and Actions You Can Take

For pet owners contemplating insurance, it's vital to explore a variety of plans that fit your pet's individual health needs. Take the time to compare different coverage types — from accident-only plans to comprehensive illness coverage. The importance of understanding the fine print in insurance policies cannot be overstated, as it can have a significant impact on your preparedness for pet-related emergencies.

The Broader Importance of Pet Insurance

Investing in pet insurance is not just a financial decision; it represents a commitment to providing your pet with the best possible health care. As awareness around pet health grows, the dialogue about responsible pet ownership will continue to advance. The UK pet insurance market clearly reflects a shift in social norms regarding animal care and the proactive steps needed in emergency situations.

In conclusion, as pet owners, staying informed and prepared is essential for ensuring the well-being of our furry friends. By understanding the market dynamics and making well-informed decisions, we can secure a better future for our pets. Explore your local pet insurance options today and consider investing in the peace of mind it can provide for you and your pet.

Add Row

Add Row  Add

Add

Write A Comment